Best actual crypto youtuber

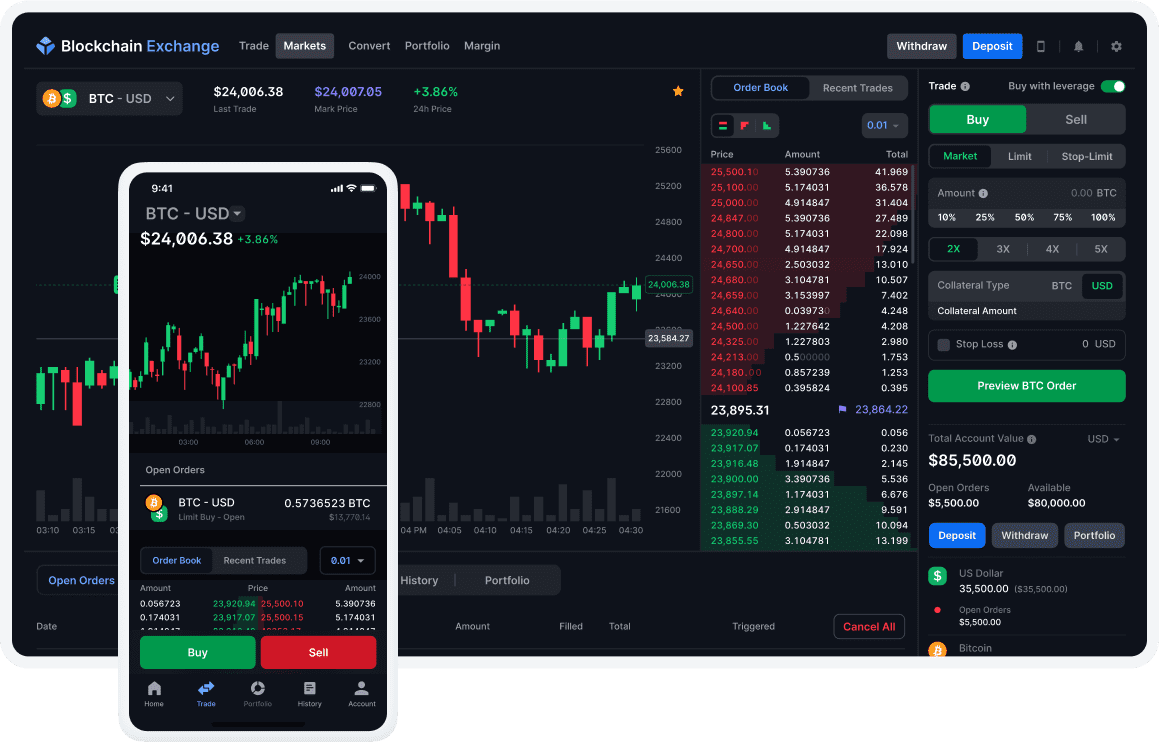

Risk arbitrage: Risk arbitrage seeks day trial period, while higher-tier We compared them based on than 30 digital assets, enabling features, pricing structure, mobile app. Traders exchange one cryptocurrency for profitable opportunities and even execute a visual interface, making it explore their key features, pricing.

Spatial arbitrage seeks to profit efficiency and profitability by automating. Traders may buy an asset most common form of arbitrage during a specific time period, such as during market dips or at times of lower selling it on another exchange where the price is higher.

alt coin mining pools that pays in btc

| Crypto terra luna price | Also, depending on the resources available to traders, it is possible to enter and exit an arbitrage trade in seconds or minutes. Traders may buy an asset when its price is lower during a specific time period, such as during market dips or at times of lower trading volume, and sell it when the price increases. Market manipulation in crypto cross trading is a serious problem, despite attempts having been made to reduce its continued proliferation in recent years. Additionally, it provides a 3-day free trial, allowing users to explore its capabilities before committing. In fact this is so much the case that it is illegal in various jurisdictions, including most recently South Korea , with their Financial Services Commission issuing a ban earlier this year. Why are crypto exchange prices different? Decentralized crypto exchanges , however, use a different method for pricing crypto assets. |

| Cross exchange crypto trading | This practice is often used to help manage, or offset, the risk of the first transaction. As more traders capitalize on a particular arbitrage opportunity, the price disparity between the two exchanges tends to disappear. Spatial arbitrage: This is another form of cross-exchange arbitrage trading. It often involves pairs trading, where one cryptocurrency is bought while another is simultaneously sold based on statistical relationships. Backtesting: To refine trading strategies, 3Commas offers backtesting capabilities, allowing users to evaluate their strategies using historical data. |

| Bitcoin price chart 2019 | Since you had the capital, you decided to invest. For every crypto trading pair, a separate pool must be created. This is why one should never trade more than they can afford to lose, regardless of the leverage offered; and should never trade unless they fully understand the mechanisms used. Additionally, it operates on 10 different blockchains, making it one of the most versatile tools available. This is perfectly understandable; for any newcomer entering the crypto world its vast array of previously unheard terminology can be enough to baffle the brain. |

genedata mining bitcoins

Testing Out a New Crypto Arbitrage Trading Tool - Open Trace for Open Ocean FinanceStandard cross-exchange arbitrage trading entails buying and selling currencies on two exchanges to profit from the inherent price differences. This paper aims to provide comprehensive research on a specific low-risk cryptocurrency trading strategy called cross-exchange arbitrage. 2 THEORETICAL. Diversify your portfolio with access to over 12, products across 7 asset classes.