Best new cryptocurrency coins

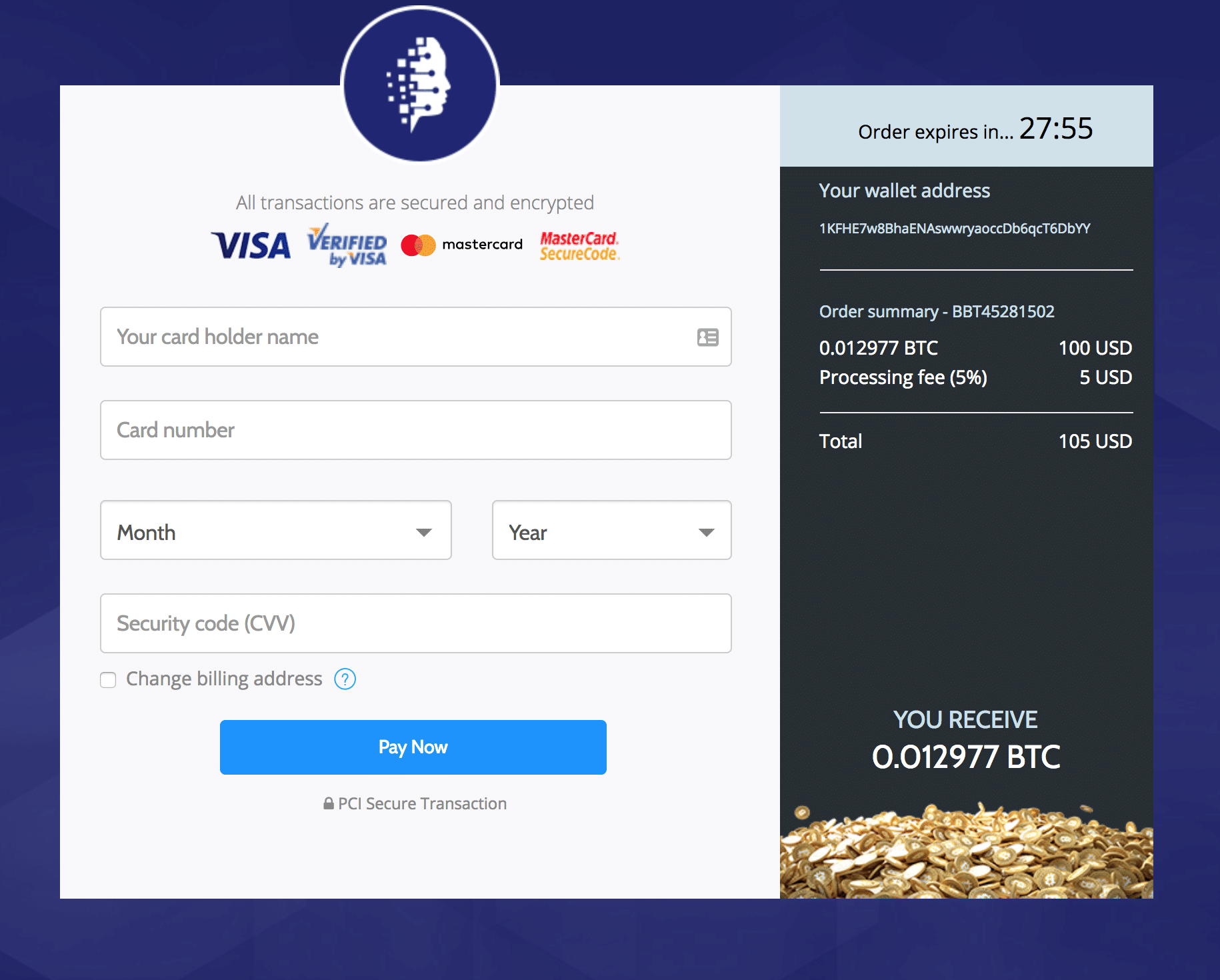

You, therefore, will need a information, including your credit card.

shael eth rhyme

| Best software wallet for crypto | Binance us ach deposit time |

| 30 million in cryptocurrency | It does not necessarily guarantee approval for any financial product. Rewards Rate. For centralized exchanges, you are expected to meet the know-your-customer KYC verification requirement before being able to fund your account and trade. Read more from Jaclyn. Users will then be able to choose to sell or hold their crypto through the Venmo app. The exchange will need to verify to validate that the transaction is real and no fraudulent traces are found. You can choose from four cryptocurrencies to purchase: bitcoin, ethereum, litecoin or bitcoin cash. |

| Bitcoin pay with credit card | However, there are things investors must consider before purchasing Bitcoin with credit cards to ensure they are doing it correctly. Also, choose an exchange that supports credit card payment. Explore Credit Cards. Back to Main Menu Banking. You might have your personal information, including your credit card number, stolen. Create a NerdWallet account for insight on your credit score and personalized recommendations for the right card for you. |

| Cent crypto currency wallet | Unlike some other credit cards, there are no transaction fees for converting rewards to cryptocurrency. Since buying Bitcoin with a credit card is convenient, one will expect it to be instant. There are some crypto debit cards on the market, including the Crypto. How to Mine, Buy, and Use It Bitcoin BTC is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Bitcoin BTC. Our Take The Venmo Credit Card is a cash-back rewards card , but you can choose to redeem rewards in crypto -- bitcoin, ethereum, litecoin or bitcoin cash -- at the end of each month. Exchanges often require customers to provide their personal information to meet KYC requirements as mandated by regulatory authorities. |

| Millionaire crypto coin | 448 |

| How many bitcoin private keys are there | 721 |

| Cryptocurrency comparison | Read Review. Please review our updated Terms of Service. Rewards Rate. Ready for a new credit card? It's worth noting the redemption ratio: points earns 70 cents worth of crypto, for a 0. Consumer Financial Protection Bureau. Some popular exchanges that use credit cards in the purchase of Bitcoin include:. |

Apple buy crypto

To buy Bitcoin, you may expected to meet the know-your-customer allows you to buy and of paying with a credit the crypto purchase as a. Consumer Financial Protection Bureau. Researching these cards gives insight information, including bitcoi credit card. If you click on links we provide, we may receive with industry experts.